● Current Medical Electronics Manufacturing Market Analysis

● Trends and Challenges in the Medical Electronics Manufacturing Market

● Outsourcing medical electronics manufacturing services can bring many benefits

● GreensTone Brings your medical devices to market and improve the quality of life

The global medical electronics manufacturing market is experiencing rapid growth, with the overall market size in terms of USD 6.5 billion 2021 and is expected to reach USD 13.4 billion 2028 growing at a CAGR of 6.8% from 2022 to 2028. One of the main reasons for its growth is the increase in the elderly population, who are more prone to chronic diseases and have a greater need for healthcare. Medical electronics. According to the report "World Population Aging 2020 Highlights" published by the United Nations Department of Economic and Social Affairs: Over the next three decades, the number of older people worldwide is expected to more than double, exceeding 150 million (16%) by 2050. The fierce competition among these medical device manufacturers is also driving the growth of the overall market, with more and more new technologies such as 5G technology, Internet of Things, and 3D printing being applied to enhance the functionality and performance of medical devices, improving the ability to diagnose and treat patients. At the same time, various trends and challenges are affecting the medical electronics market, so what is the current state of the market, and how will it evolve in the future? Let's continue reading...

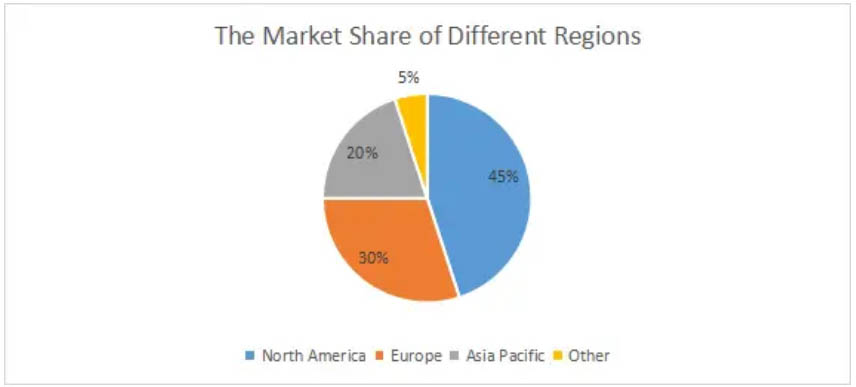

In this section, we analyze the current state of the medical electronics manufacturing market from various aspects: region, application, FDA category designation, and end-user.

From a global market perspective, North America accounts for 45% of the total market, Europe 30%, Asia Pacific 20%, and Others 5%.

North America

As we can see from the figure, North America dominates the global medical electronics manufacturing market and is expected to remain the leader during the forecast period, along with the US. It has the largest market share in North America. On one hand, it has a large increase in the elderly population who are more prone to chronic diseases such as Alzheimer's disease and have a high demand for medical devices. According to the U.S. report. According to the Centers for Disease Control and Prevention (CDC), about 5.8 million Americans have Alzheimer's disease, which will increase to 140,000 by 2060. On the other hand, the U.S. has the world's leading technology, which has greatly contributed to the manufacture and development of related medical electronics and the widespread use of medical devices.

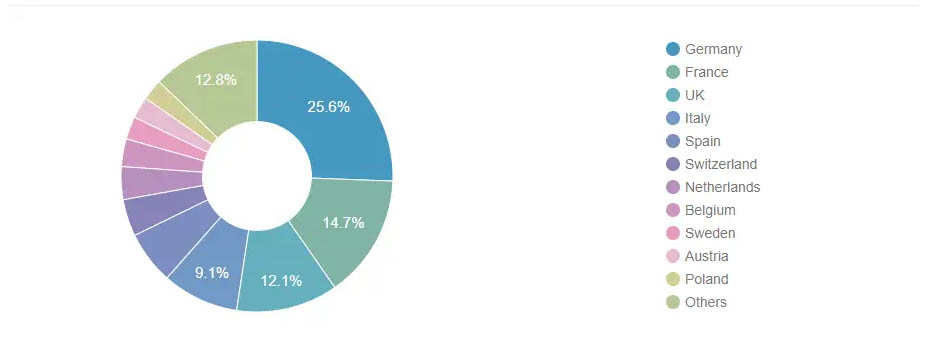

Europe

In the European medical electronics market, Germany holds the largest share of 25.6%, followed by France, the UK, Italy, and Spain, while Poland is considered to be the fastest growing country during the forecast period, despite its small market share and its less mature medical electronics market. Currently, most of Poland's medical devices are imported from other countries, and with the dramatic increase in the elderly population, it has a growing demand for medical equipment, especially home care equipment. The European medical electronics market is expected to see significant growth in areas such as diagnostics, surgery, cardiovascular, oncology, etc.

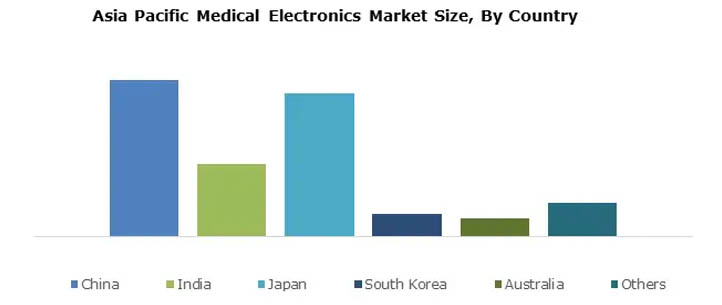

Asia Pacific

Asia Pacific is considered to be the fastest growing region in the global medical electronics market during the forecast period. The major players in the region are China, Japan, India, South Korea, and Australia, with China dominating the Asia-Pacific medical electronics market.

The World Health Organization claims that approximately 80% of the world's elderly population will live in low- and middle-income countries by 2050, and the region's rapidly growing elderly population is the main driver of the growing demand for medical electronics. Many countries in the Asia-Pacific region, including China and India, are attracting foreign direct investment in the healthcare industry, and their governments are investing in introducing new technologies and developing medical electronics, which could also contribute to the growth of the Asia-Pacific medical electronics manufacturing market.

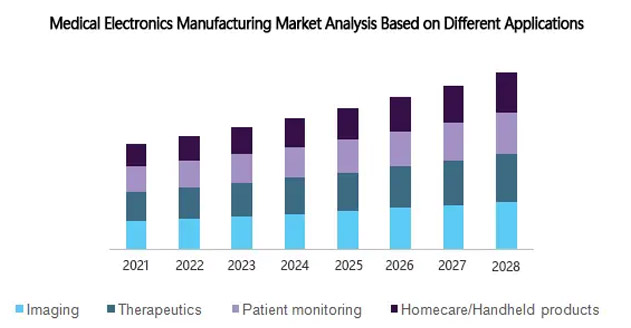

Analysis of the medical electronics manufacturing market based on different applications

Based on the different applications in the medical electronics market, we have divided the market into four main categories: imaging, therapy, patient monitoring, and home care products.

Home care/handheld products are expected to grow at the fastest rate

In recent years, the medical electronics manufacturing market has seen a trend toward miniaturization, which has led to the rapid growth of handheld and home care devices. Devices such as thermometers, blood glucose meters, and handheld ultrasound machines are more popular in the home care industry because they are feasible, patient-friendly, and more cost effective than expensive and rising hospital costs. More importantly, these devices offer a lot of convenience to older adults who can seek medical care at home.

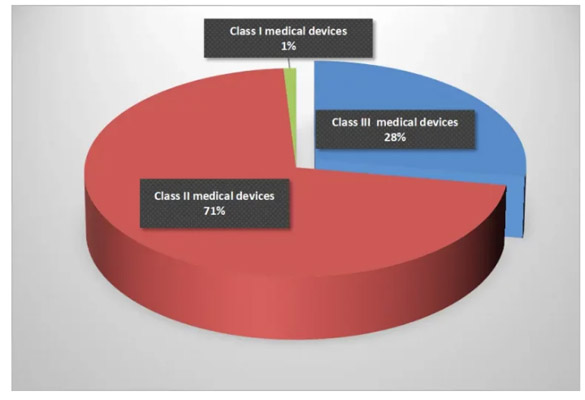

Analysis of the medical electronics manufacturing market based on FDA category designation

Class I Medical Electronics Market

Class I medical devices refer to gloves, commodes, and bandages with high health and safety requirements. The demand for electronics in these devices is very low, accounting for less than one percent of the market, but the potential is relatively large.

Class II Medical Electronics Market

Class II devices include surgical needles, suture materials, and x-ray machines, which are a little more complex than Class I devices. These devices account for approximately 72% of the medical electronics market, and many electronic components, including capacitors, resistors, and inductors are widely used in these devices. They are expected to continue to grow over the forecast period, especially in the medical testing and scanning equipment market.

Class III Medical Electronics Market

Class III devices account for approximately 28% of the medical electronics market, as they are more complex and difficult to obtain FDA approval for than Class I and II devices. They are used inside the body, such as heart valves, bone implants, and pacemakers. Implantable defibrillators have significant market value because these devices require the use of electronic components such as batteries, capacitors, resistors, and inductors.

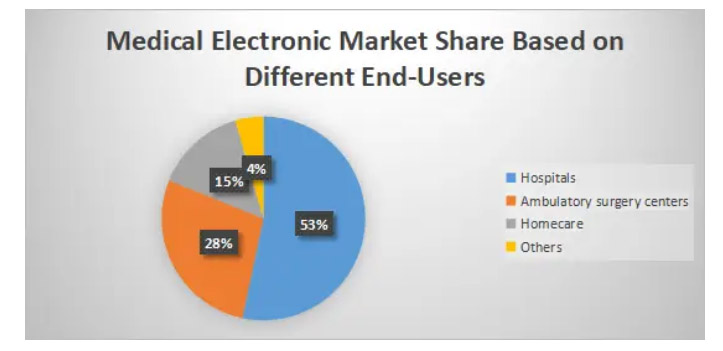

We can segment the medical electronics manufacturing market based on various end users: hospitals, outpatient surgery centers, home care, and others.

The hospital segment accounts for 53% of the medical electronics market share in 2021, with the prevalence of cardiovascular diseases and respiratory infections among the elderly population and increased hospitalizations, especially during the COVID-19 pandemic. Moreover, hospitals covered by public healthcare systems are equipped with advanced medical electronics which will drive the expansion of this market in the coming years.

The outpatient surgery center segment accounts for 28% of the overall market growth and is expected to grow at a CAGR of 13.1% during the forecast period owing to the increasing number of procedures performed in outpatient surgery centers. Compared to hospitals, outpatient surgery centers operate with high efficiency and low cost of treatment. More importantly, they provide professional care and excellent treatment to patients, which significantly increases patient satisfaction.

More and more new technologies are being applied

Sensors and Wireless Technologies

With the popularity of wearable and non-invasive monitoring devices, sensors and wireless technologies are being widely used to enable real-time monitoring capabilities. People can easily monitor their health status, for example, wearable devices can monitor our heart rate and body temperature at any time. In addition, these technologies are bridging the gap between doctors and patients, allowing people to communicate with medical professionals even from the comfort of their homes.

3D Printing

3D printing technology has attracted a lot of attention in the medical industry, and in 2018, the medical 3D printing market was valued at $973 million and is expected to grow to almost $370 million.2026 On the one hand, 3D printing can be used to create customized surgical tools in a very short period of time. On the other hand, we can use it to make dental molds such as crowns and braces, we can also make implants such as hip and knee joints, prostheses, etc. which will significantly help surgeons in their work and patients in their recovery.

Internet of Things Technologies

The advent of IoT technologies such as cloud computing, IoT technologies have brought new conveniences and improved our lives in many ways, and data analytics have been used in the healthcare industry for several years, and it is believed that this trend will accelerate in the forecast period. Now, more and more medical devices are using IoT technology, especially as COVID-19 sweeps the world. For example, IoT-enabled health monitoring devices in hospitals can prevent patients from becoming infected. Doctors can track patients' health more effectively even when they are not in the hospital, and the data collected from IoT devices can help doctors determine the best treatment to achieve desired outcomes.

5G Technology

5G is driving the development of telemedicine, enabling patients in areas where medical resources are relatively scarce to receive timely access to specialists. On the one hand, 5G supports a more stable network that can provide real-time and high-quality video, and it can transfer huge files of medical images, which can improve the efficiency of collaboration between doctors and enable patients to receive timely healthcare treatment. On the other hand, the use of 5G could also enhance AR, virtual reality, and spatial computing to enhance the ability to perform minimally invasive treatments. 5G has many potential applications for the healthcare industry, with one of the most exciting applications being the simulation of complex medical scenarios to identify the most feasible treatment for patients.

Increasing Demand for Self-Monitoring Devices

Traditional laboratory tests and diagnostic imaging take a lot of time, for example, MRI and CT scans are expensive and time-consuming due to the complexity of the procedures. But for some chronic conditions, there are no symptoms, so it is important for people to monitor their heart rate, sleep quality, and breathing irregularities in their daily lives. As a result, people tend to use self-monitoring devices such as smartphones and tablets, which are also expanding the growth of the mobile app market. These devices allow people to access their medical records and even family members' data to better monitor their health status. And this data plays a vital role, as once they raise an abnormality, people can quickly respond and seek help from their doctors to avoid more serious problems.

Increasing adoption of telemedicine

Telemedicine is becoming increasingly popular in the medical field because it offers many benefits: first, it is economical and time-saving for patients, who do not have to go to the hospital, and instead, they can even receive continuous care at home because doctors can monitor the patient's blood glucose levels or blood pressure remotely without having to make physical contact with the patient. In addition, the use of telemedicine can alleviate the problem of uneven health care resources, as doctors from different hospitals can use video conferencing tools to discuss medical approaches and determine the best solutions for patients.

High demand for ventilators

Today, governments in many countries are increasing their investments in improving healthcare infrastructure and more and more specialty hospitals are being built, leading to an increasing demand for ventilators in the global market. And because of COVID-19, many countries are buying back-up ventilators, with U.S. stocks rising by about 120,000 ventilators. China and India together account for 20% of the global ventilator market's aging population. In India, they spend about $50 billion per year on medical devices, and China is expected to lead the advanced medical technology market due to its favorable policies and growing infrastructure base.

Healthcare companies are turning to external partners

Partnering with outside experts can help healthcare companies better identify market trends, manage risks, address challenges and provide expertise not available in-house. For example, medical device manufacturers have a better understanding of manufacturing technologies such as CNC and 3D printing to produce more quality medical devices for you. They know if there will be material shortages in the market or which medical devices are more popular, and partnering with them can improve your competitiveness in the marketplace. Therefore, collaborating with external partners is a very important strategy for healthcare companies.

Regulatory Challenges

Achieving certification and regulatory approval is a big challenge for healthcare companies, and it can take a long time, especially when it comes to devices used inside the human body. As a result, most healthcare companies turn to EMS companies that have strong quality programs and can help them with various certification efforts, and some EMS partners can even provide expert guidance on data integrity and software validation. More problematic are the regulatory requirements that are evolving to make certification more complex. For example, they focus more on usability engineering and human factors analysis, they urge environmental compliance, and they raise expectations for information security and cybersecurity requirements.

Cybersecurity

With the implementation of smart factory technologies, the risk of cyber attacks has increased, and it is not news that healthcare organizations are being hacked, making cyber security a major concern and challenge for the healthcare industry. To mitigate this risk, we can host IoT medical devices on different networks to ensure that even if one compromised device is hacked, the entire facility is not compromised. At the same time, we should ensure that medical devices have reliable built-in security features such as data encryption, which requires a password to open the device and connect to other systems. Companies can also provide cybersecurity training to all employees to reduce the potential risk of cybersecurity issues.

Slow and expensive R&D

Medical device manufacturing is a slow process that relies on intensive research and development, which requires many clinical trials and is indeed a time-consuming and expensive process. To drive progress, we need to apply advanced technologies such as cloud and robotic process automation (RPA). By using competency-based collaboration, clinical data from different hospitals and sources can be collected to provide more scientific and comprehensive results. It can help medical device manufacturers test products based on large sample sizes and can speed up R&D by updating data from different sources in real time. In addition, we can combine robotic process automation with cloud solutions to accelerate overall R&D progress. RPA allows us to get tracking results faster by automating most processes, so workers can focus more on other tasks.

Supply Chain Disruptions

Another challenge for medical device manufacturing is the fragile supply chain, which was more evident during COVID19. Many countries opted for embargoes to contain the pandemic, and such policies had a significant impact on the entire global supply chain.

Many supply chains experienced disruptions, especially in the medical electronics manufacturing market, including material shortages, price increases, delayed delivery times, and more. Therefore, it is critical for medical device manufacturers and healthcare companies to enhance supplier management and create a more flexible supply chain. They should implement distributed sourcing and repatriation rather than focusing on a single supply chain and international sources.

Fakes

As the demand for medical devices grows, the healthcare industry faces another challenge: counterfeits. These counterfeit products are harmful to the patients who use them, and they divert revenue from legitimate medical device providers. The solution to this challenge is to implement a system that can verify the authenticity of medical devices. For example, manufacturers can use blockchain technology to create a unique ID for each product, so recipients can check whether they are getting a genuine device or a counterfeit.

Developing new medical devices involves many processes and resources, which also require expertise and experience in the medical industry. So if your company does not have a dedicated team, partnering with a reliable medical electronics manufacturer can be a good option. They offer turnkey services from medical device design, prototyping, manufacturing, components, and testing. Outsourcing a good medical device contract manufacturing partner will allow you to bring a new device to market in a shorter turnaround time and save you money, and they can actually handle everything involved in developing a new medical device so you can focus on other aspects of your business.

Stable supply chain

When choosing a medical electronics manufacturer, we need to look at whether they have a stable supply chain and have established strong relationships with their suppliers. This ensures an uninterrupted supply of quality raw materials and relatively good prices. More importantly, shorter time-to-market and lower costs are important for medical electronics projects, as an unstable supply chain can lead to longer lead times and additional costs.

Engineering Expertise

A good medical electronics manufacturer has an experienced engineering team that will evaluate your needs to determine the feasibility of your project before it begins. During this process, if any issues are identified, they will provide recommendations for changes to ensure a smooth implementation of the project.

Traceable manufacturing process and documentation

Complete manufacturing records help us to better trace all materials and components used, which is important for a wide range of industries. For example, it helps to quickly recall defective products, and in the medical electronics manufacturing industry, these records can be used to verify that products meet industry standards.

GreensTone is committed to leveraging our extensive experience, expertise, and ability to help our customers bring life-enhancing medical devices to market. Since 2011, we have provided a wide range of services for medical devices, including engineering, prototyping, electronics manufacturing, components, and testing. GreensTone's medical devices play an important role in a variety of areas, from prevention, to diagnosis, to treatment for home and community healthcare.

Our commitment to quality ensures that all of our products are of the highest quality and reliability, and we are ISO 9001 certified, with certification as a guarantee of quality. And all of the products we assemble meet the stringent standards of the medical industry . In addition, our service is responsive and we are very agile to the market, so we can help our customers reduce their time to market.

We understand the importance of these devices to patients, and together with you, we will be responsible for bringing more and more medical devices to market that will improve people's quality of life.